The Indian stock market has shown robust growth with a 45% increase over the past year, while remaining stable in the last week. In this dynamic environment, dividend stocks that can potentially offer steady returns and align with projected earnings growth of 16% per annum might be particularly appealing to investors looking for both stability and growth.

Top 10 Dividend Stocks In India

|

Name |

Dividend Yield |

Dividend Rating |

|

Balmer Lawrie Investments (BSE:532485) |

3.84% |

★★★★★★ |

|

D. B (NSEI:DBCORP) |

3.53% |

★★★★★☆ |

|

Gulf Oil Lubricants India (NSEI:GULFOILLUB) |

3.29% |

★★★★★☆ |

|

HCL Technologies (NSEI:HCLTECH) |

3.31% |

★★★★★☆ |

|

Indian Oil (NSEI:IOC) |

8.20% |

★★★★★☆ |

|

Bharat Petroleum (NSEI:BPCL) |

6.65% |

★★★★★☆ |

|

VST Industries (BSE:509966) |

3.59% |

★★★★★☆ |

|

Oil and Natural Gas (NSEI:ONGC) |

3.80% |

★★★★★☆ |

|

PTC India (NSEI:PTC) |

3.54% |

★★★★★☆ |

|

Swaraj Engines (NSEI:SWARAJENG) |

3.32% |

★★★★☆☆ |

Click here to see the full list of 15 stocks from our Top Indian Dividend Stocks screener.

Let’s explore several standout options from the results in the screener.

Simply Wall St Dividend Rating: ★★★★★☆

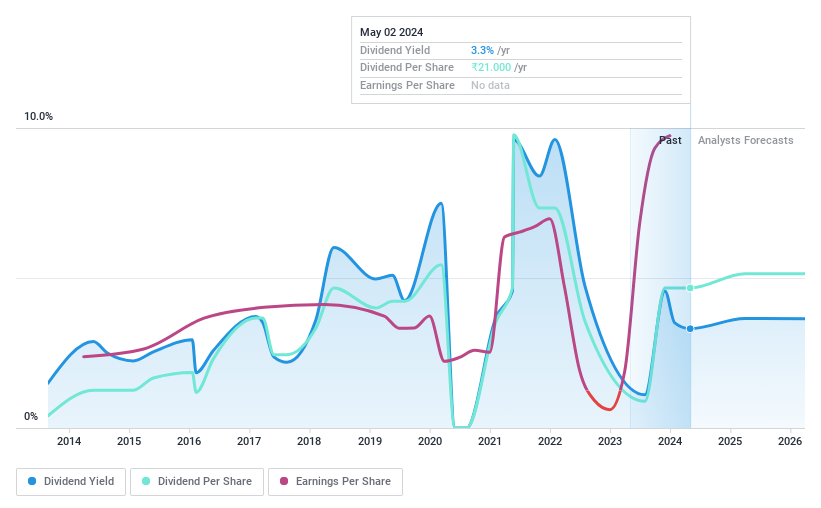

Overview: Bharat Petroleum Corporation Limited, operating in India, focuses on refining crude oil and marketing petroleum products, with a market capitalization of approximately ₹1.37 trillion.

Operations: Bharat Petroleum’s revenue is primarily derived from its Downstream Petroleum segment, which generated ₹50.68 billion, and a smaller contribution from its Exploration & Production of Hydrocarbons segment at ₹1.88 billion.

Dividend Yield: 6.6%

Bharat Petroleum (BPCL) offers a dividend yield of 6.65%, ranking in the top 25% of Indian dividend payers. Despite its attractive yield, BPCL’s dividends have shown volatility over the past decade. The company maintains a low payout ratio of 33.3% and cash payout ratio of 34.6%, indicating that dividends are well-covered by earnings and cash flow, respectively. However, BPCL faces challenges with an unstable dividend track record and high debt levels, alongside an expected decline in earnings by an average of 31.8% annually over the next three years.

Simply Wall St Dividend Rating: ★★★★☆☆

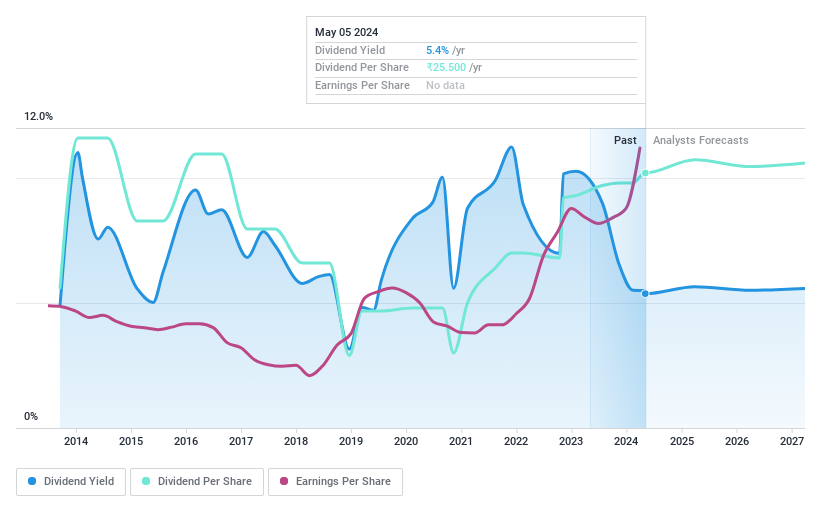

Overview: Coal India Limited, along with its subsidiaries, engages in the production and marketing of coal and coal products across India, boasting a market capitalization of approximately ₹3.16 trillion.

Operations: Coal India Limited generates revenue primarily from its coal mining and services segment, amounting to approximately ₹13.03 billion.

Dividend Yield: 5%

Coal India’s dividend yield of 4.98% positions it in the top quartile of Indian dividend payers, but its sustainability is questionable with a cash payout ratio exceeding 1200%. While the company has increased dividends over the past decade, payments have been inconsistent, reflecting volatility. Recent operational improvements show a year-over-year production increase from 175.5 million tonnes to 189.3 million tonnes in Q2, potentially supporting future dividends despite current cash flow challenges.

Simply Wall St Dividend Rating: ★★★★★☆

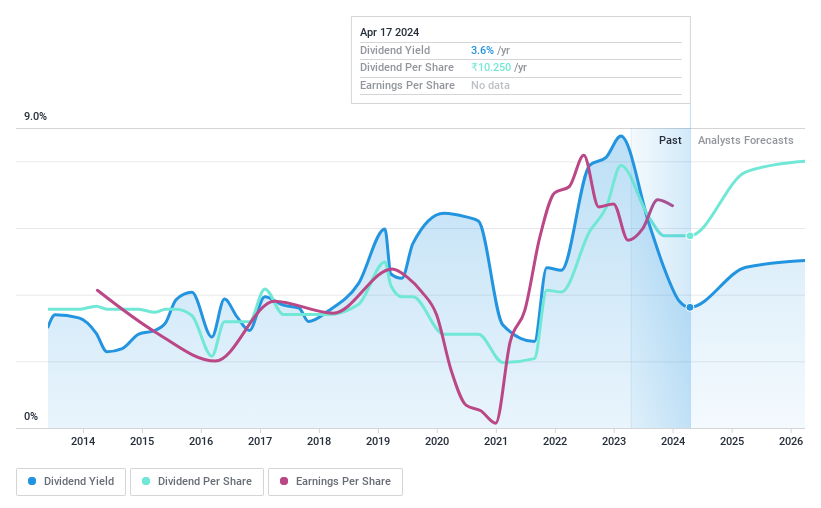

Overview: Oil and Natural Gas Corporation Limited, with a market capitalization of ₹4.06 trillion, is engaged in the exploration, development, and production of crude oil and natural gas both domestically in India and internationally.

Operations: Oil and Natural Gas Corporation Limited generates ₹56.75 billion from refining and marketing, while its onshore and offshore exploration and production segments in India contribute ₹4.39 billion and ₹9.43 billion respectively.

Dividend Yield: 3.8%

Oil and Natural Gas Corporation Limited (ONGC) has demonstrated a stable dividend policy, with a recent increase in dividends reflecting confidence in its financial health. The company maintains a low payout ratio of 31.3% from earnings and 32.5% from cash flows, ensuring that dividends are well-supported. Despite historical volatility in dividend payments, ONGC’s current yield of 3.8% ranks well above the market average, offering an attractive option for dividend seekers. Recent executive changes could signal continued strategic focus on financial discipline and growth.

Taking Advantage

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:BPCL NSEI:COALINDIA and NSEI:ONGC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]