Semiconductor stocks are a hot area to invest in thanks to the emergence of new industries, such as electric vehicles (EVs), renewable energy, and artificial intelligence. Consequently, many of these stocks experienced skyrocketing share prices, making it hard to find bargains in this sector.

But one potentially undervalued semiconductor stock is Wolfspeed (NYSE: WOLF). The company’s shares are down about 80% over the past 12 months through Feb. 5. Wolfspeed produces silicon carbide (SiC) wafers and components. Silicon carbide’s properties make it ideal for power-related applications, such as for EV charging and for storing energy from solar and other renewable sources.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

If SiC products are desirable for industries on the rise, why is Wolfspeed stock down? Does this create a buy opportunity? Or are there reasons to avoid the stock? Let’s dive into the company to find out.

Factors in Wolfspeed stock’s decline

The staggering drop in Wolfspeed shares over the past year is related to its deteriorating business. Its sales are struggling, and its CEO departed in November.

The challenges facing Wolfspeed are illustrated in the company’s recently announced results for its fiscal second quarter, ended Dec. 29. Q2 revenue totaled $180.5 million, which is a sharp decline from the prior year’s $208.4 million. The sales drop was due to softness in customer demand in the industrial and energy sectors. Wolfspeed operates in a cyclical market, so periods of weaker customer demand are a natural part of its business.

But as a result, the semiconductor giant forecasts fiscal Q3 revenue to come in between $170 million to $200 million. This would be a drop from the prior year’s sales of $201 million. With consecutive quarters of sales declines and the current downturn in some of its markets, it’s fair to ask if the company has the financial strength to weather this situation until markets rebound. That brings us to more factors adding to its share price decline.

Wolfspeed’s additional challenges

Wolfspeed’s declining sales created other issues, including mounting losses. The company exited Q2 with a net loss of $372.2 million, which is substantially higher than the prior year’s $144.7 million loss. The situation is made worse by the company’s Q2 negative gross margin of 21%. The previous year’s gross margin was a positive 13%. The negative margin indicates Wolfspeed’s costs to produce revenue are greater than the income it’s bringing in from its offerings.

The company can’t rectify this simply by raising prices due to competition. Newer Chinese players are pursuing aggressive pricing to capture customers, putting pressure on established companies, such as Wolfspeed, to keep prices low. Instead, the company is working to reduce costs. It’s shutting down older manufacturing locations in favor of its newer Mohawk Valley fabrication facility, and it cut staffing.

In the short term, this added millions of dollars in restructuring charges through the first half of Wolfspeed’s fiscal 2025. That’s one reason behind the big year-over-year rise in Q2 net loss. But over the long term, the cost savings should help the semiconductor giant see a light at the end of this dark time.

Reasons to consider an investment in Wolfspeed

Wolfspeed’s situation isn’t all doom and gloom. It is the market leader in SiC wafer and epiwafer production. Also, the company saw demand increase in the automotive sector, which suggests a recovery in this key market may be on the way.

In addition, Wolfspeed is ramping up production at its Mohawk Valley fab. This resulted in the location generating revenue of $52 million in Q2, up from $12 million in the previous year. Revenue at this facility should continue to rise as it further increases production.

Wolfspeed management has committed to achieving profitability and strengthening its financials over the long term. Helping it do so is the company’s approval for $750 million in CHIPS Act funding from the U.S. government, and it secured another $750 million in financing from a group of investors.

Also the SiC industry is forecast to grow from around $4 billion to $5 billion this year to over $11 billion by 2030. The SiC market’s expansion provides a tailwind to Wolfspeed’s sales growth.

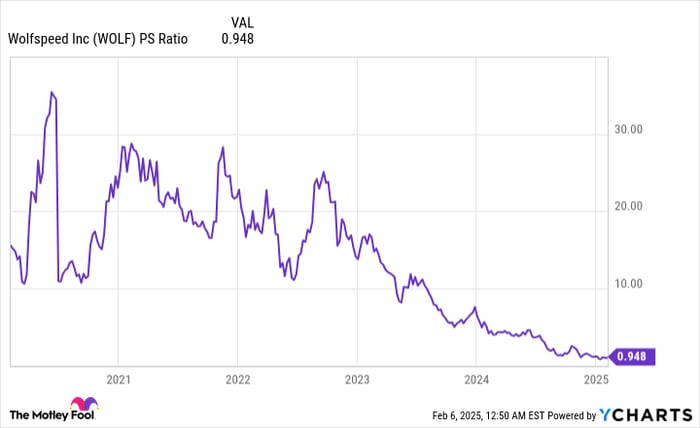

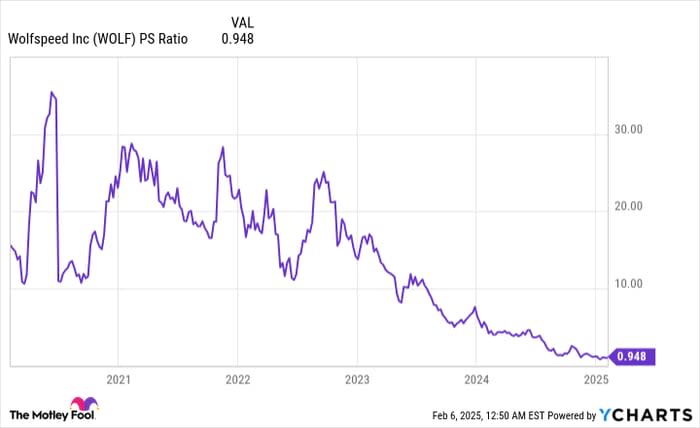

Data by YCharts.

Lastly, from a stock-valuation perspective, now is an attractive time to invest in Wolfspeed. A look at the company’s price-to-sales (P/S) ratio, which measures how much investors are willing to pay for every dollar of revenue, shows it’s around one. Wolfspeed stock’s P/S multiple reveals it’s hovering at the lowest level in years at the time of writing. This suggests its share price is undervalued.

Still, its financial struggles mean any investment in Wolfspeed is a risk. So only investors with a high risk tolerance should consider an investment — and they should expect to wait a few quarters, possibly years, to see if the company can emerge triumphant from its current slump.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $336,677!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,109!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $546,804!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of February 3, 2025

Robert Izquierdo has positions in Wolfspeed. The Motley Fool has positions in and recommends Wolfspeed. The Motley Fool has a disclosure policy.