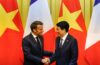

Traders work frantically on the floor of the New York Stock Exchange on “Black Monday” in 1987, one of several significant crashes to happen in October. That history – and a fair dash of folklore – has led many investors to approach the month with caution. Photo / Peter Morgan, AP

OPINION

In the labyrinthine landscape of the stock market, investors are continually on the lookout for clues, patterns and trends that could unlock the mysteries of market movements.

From the fabled “January effect” to the

infamous belief that “October is always a bad month”, the allure of identifying predictable patterns in the stock market has fascinated investors for generations.

What drives this relentless pursuit of trends, and how reliable are these historical phenomena as guides for future investment decisions?

Elections and Market Movements

With the upcoming US election in mind, many investors will be wondering what impact it will have on financial markets. The American election cycle introduces a myriad of uncertainties and variables that can significantly influence market behaviour.

The “presidential election cycle theory” suggests markets tend to perform better in the third year of a president’s term, especially leading up to the election.

Investors closely monitor election campaigns, policy proposals and political developments for potential impacts on sectors such as healthcare, energy and financial services.

However, the relationship between elections and market performance is complex and not always consistent, and influenced by many other factors such as incumbent policies, geopolitical events and economic factors.

Human nature and the urge to predict

At the heart of the fascination with stock market trends lies a fundamental aspect of human nature: the inclination to seek order and meaning. Human beings are wired to recognise patterns, whether in the natural world, social interactions or the prosaic domain of financial data.

This innate cognitive bias towards pattern recognition often leads investors to scour historical data in search of recurring trends that could offer insights into future market behaviour.

The elusive January effect

One of the most widely studied and debated trends in the stock market is the phenomenon known as the “January effect”. According to this theory, stock prices in the US tend to rise in January, particularly for small-cap stocks.

Proponents of the January effect argue this uptick in prices is driven by year-end tax-loss selling followed by bargain hunting in the new year. While empirical evidence supporting the January effect is mixed, its enduring popularity among investors highlights the persistent quest for predictable patterns in market movements.

October’s notorious reputation

Similarly, the belief that “October is always a bad month” has become ingrained in investor folklore.

Historically, October has witnessed several significant market crashes, including the infamous Black Monday of 1987.

This association between October and market downturns has led many investors to approach the month with caution and adjust their investment strategies accordingly. While October may indeed have a higher frequency of stock market volatility, the long-term statistics do not reflect the belief in the month being uniquely different.

Market seasonality, epitomised also by the “sell in May and go away” strategy, advocates adjusting investments based on historical seasonal market patterns.

While these strategies may have merit in specific conditions, blindly adhering to seasonal trends without considering broader economic fundamentals can expose investors to unnecessary risks.

Earnings season insights

In addition to seasonal trends, investors also analyse patterns related to earnings season.

During earnings season, when companies release their earnings reports, there may be discernible patterns in how stock prices react to these announcements.

Some investors look for patterns such as the “earnings surprise effect” or the “post-earnings announcement drift” to identify opportunities for profit.

Again, the efficacy of these patterns depends on various factors, including the accuracy of earnings forecasts, market sentiment and broader economic conditions.

To conclude, the pursuit of stock market trends reflects humanity’s quest for order and predictability in an inherently uncertain world.

While certain patterns may exhibit statistical significance, markets are complex adaptive systems influenced by many factors – not least currently by technological advancements. Investors must exercise prudence and critical thinking when incorporating trend analysis into their investment strategies.

By combining historical insights with rigorous research, disciplined risk management and a long-term investment strategy, investors can navigate the ever-changing landscape of the stock market with confidence and resilience, especially as they consider the unique influence of elections on market dynamics.

Mark Logan is a wealth management adviser at Jarden.

The information in this research solely relates to the companies and investment opportunities specified within. We recommend that you seek financial advice specific to your circumstances before making any investment decision or taking any action. Jarden Securities Ltd is an NZX firm. A financial advice disclosure statement is available free of charge at https://www.jarden.co.nz/our-services/wealth-management/financial-advice-provider-disclosure-statement/.

Full disclaimer available at: https://www.jarden.co.nz/wealth-sales-and-research-disclaimer.