This is CNBC’s live blog covering Asia-Pacific markets.

Asia-Pacific markets mostly rose on Friday despite a plunge in all three benchmarks in the U.S. over the previous session amid concern about President Donald Trump’s tariff plans.

Mainland China’s CSI 300 reversed its losses on Thursday to trade 2.4% higher at 11:47 a.m. Singapore time, leading gains in Asia. The increase was led by stocks in the healthcare, consumer cyclicals and non-cyclicals sectors.

Hong Kong’s Hang Seng Index also saw substantial gains, rising 2.22%.

Australia’s S&P/ASX 200 gained 0.39%, also reversing course from losses in the previous session.

In Japan, the benchmark Nikkei 225 rose 0.35% while the broader Topix index gained 0.40%.

South Korea’s Kospi index traded flat while the small-cap Kosdaq advanced 1.82%.

It comes after another escalation in the developing trade war, with Trump threatening to enact 200% tariffs on all alcoholic products coming from the European Union in retaliation for the bloc’s 50% tariff on whiskey. Trump on Thursday said, “I’m not going to bend at all” regarding tariffs.

Michael Strobaek, global chief investment officer at private bank Lombard Odier, noted that uncertainties around Trump’s policies “means market risk.”

“There will be so much for markets to digest, and navigate so many ‘unknown unknowns’,” he wrote in a Friday note.

He suggested that investors play the market by “filtering out the noise.” “The macroeconomic and market fundamentals remain solid, but there will be a lot of uncertainty ahead. In the face of volatility, a high degree of diversification is the prudent portfolio response,” Strobaek added.

U.S. futures rose on Friday after ending in the red on the back of new tariff threats from Trump.

The S&P 500 dropped 1.39% on Thursday to settle at 5,521.52, ending the day in correction territory. The Dow Jones Industrial Average fell 1.3%, while the Nasdaq Composite shed 1.96%.

— CNBC’s Lisa Kailai Han and Pia Singh contributed to this report.

China’s CSI 300 jumps after a volatile week

China’s CSI 300 index — which captures the top 300 stocks traded on the Shenzhen Stock Exchange and Shanghai Stock Exchange — was trading well over 2% higher on Friday.

It follows U.S. futures higher after a volatile week on Wall Street which saw the S&P 500 end Thursday in correction territory.

The ChinaAMC CSI 300 Index ETF shows the day’s moves:

— Katrina Bishop

BoJ likely to hold interest rates steady in upcoming monetary policy meeting: MFS Investment Management

MFS Investment Management expects the Bank of Japan to hold interest rates in its upcoming monetary policy meeting on Mar. 18 and 19 on the back of strong inflation and wage growth expectations.

Earlier this week, Japan’s revised GDP for the fourth quarter came in at 2.2% on an annualized basis, below economists’ expectations and the previous estimate of 2.8% growth. The country’s inflation rate climbed to a 2-year high of 4% in January.

“The BoJ appears broadly comfortable with bond yields rising in response, implying higher expectations for the terminal rate and more of a normal yield curve. This also suggests a high bar for market intervention from the Bank in the absence of heavy bond market dysfunction,” Carl Ang, fixed income research analyst at MFS Investment Management, wrote in a Friday note.

Yields on Japanese government bonds have been rising. The 10-year JGB yield has ticked up slightly to 1.545%, while the 30-year JGB yield has edged down marginally to 2.59%.

Looking ahead, Ang expects the Japanese central bank to have “steady rate hikes of 0.25% roughly every six months.” Based on this, his expectation is for the next rate hike to be in June.

— Amala Balakrishner

Samsung SDI shares fall over 7% following $1.38 billion share issuance

Shares in Samsung SDI fell as much as 7.21% on Friday, following its announcement on the issuance of new shares worth 2 trillion won ($1.38 billion).

The proceeds from this will be invested in a joint venture with automotive giant General Motors and for the expansion of its factory capacity in Hungary among others, the battery and electronics materials manufacturer said in a regulatory filing.

— Amala Balakrishner

Japanese yen depreciates 0.29% against the U.S. dollar

The Japanese yen depreciated 0.29% against the U.S. dollar to 148.25 on Friday, after notching near five-month highs earlier in the week{=null}.

The Korean won similarly was down 0.15% to 1,455.40 against the dollar.

Elsewhere in Asia-Pacific, the Australian dollar weakened by 0.1% against the U.S. dollar to 0.6289, while the offshore Chinese yuan weakened marginally by 0.05% against the U.S. dollar to 7.25.

— Amala Balakrishner

Spot gold appreciates 0.14% against the U.S. dollar to hit record high

Spot gold hit a record high of $2,989.86 per ounce on Thursday. By 9.45am Singapore time, it was off high and was trading around $2,986.90 per ounce.

Gold prices appear to be nearing the key milestone of $3,000 per ounce. The uncertainties surrounding U.S. President Donald Trump’s tariff plans and bets on monetary policy easing by the Federal Reserve have been pushing up the price.

— Amala Balakrishner

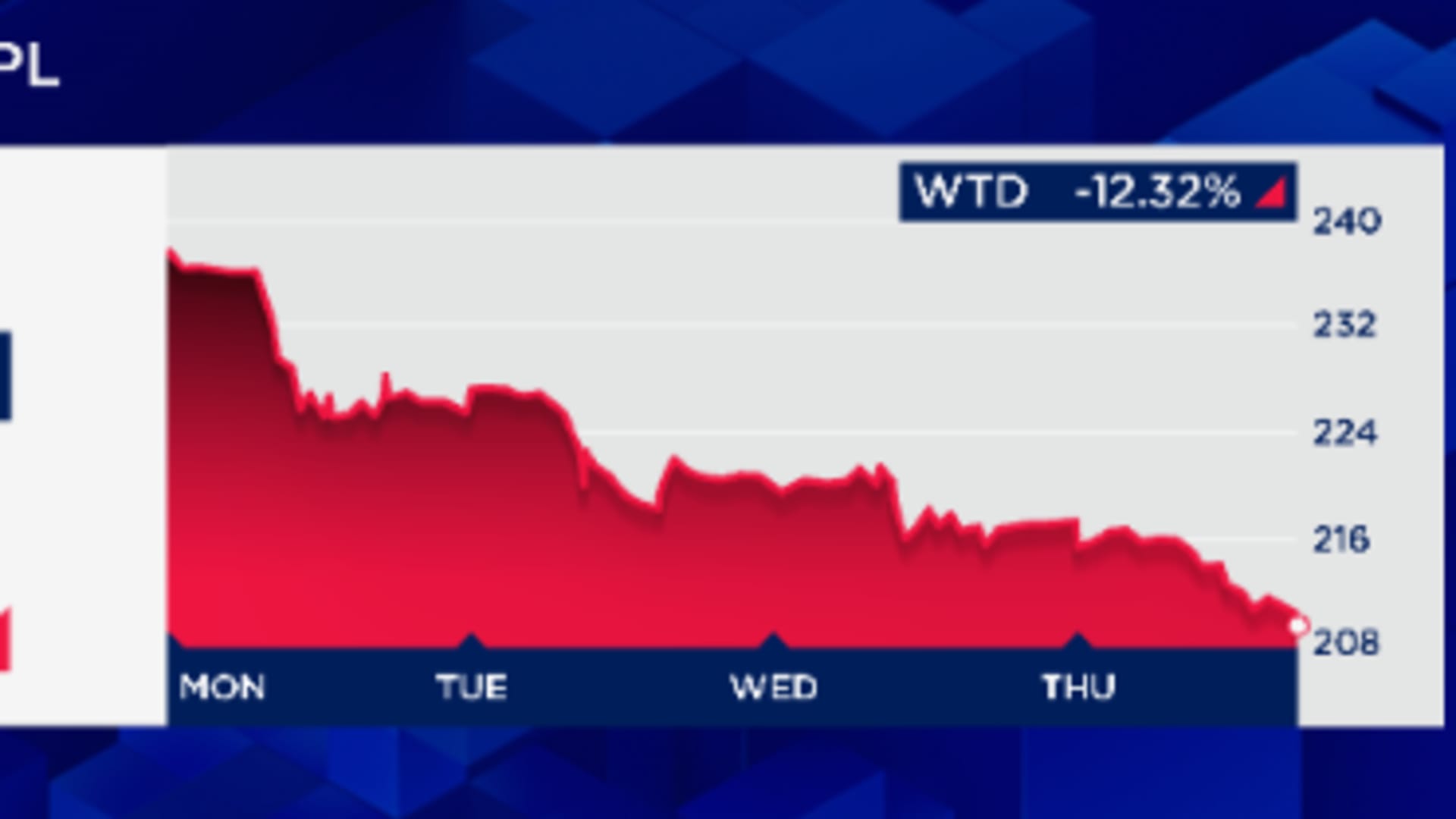

Apple on track for worst week since March 2020

Apple shares have fallen more than 12% this week, on track for its worst week since March 2020.

The iPhone maker is trading at its lowest level since August 2024 after falling 11 of the past 13 trading days. Since its record close in December, the company has lost nearly 20% of its value, or around $776 billion in market cap.

— Adrian van Hauwermeiren

Barclays sees additional rate cut in September

Barclays believes President Trump’s higher tariff policies could lower U.S. GDP and raise inflation in the near term. On the back of these assumptions, the bank recently added one more interest rate cut to its forecast for this year.

“We now expect the FOMC to lower rates 25bp twice this year, in June and in September. We added another rate cut to our previous baseline that assumed one rate cut in June,” wrote chief U.S. economist Marc Giannoni. “For 2026, we expect three 25bp rate cuts, in March, June and September.”

— Lisa Kailai Han