Suppliers from the Middle East & North Africa (MENA) are widely expected to gain market share in the European flat steel market in the coming years as a result of the EU’s Carbon Border Adjustment Mechanism (CBAM) and an anti-dumping probe against Asian suppliers, sources told Fastmarkets on Thursday, August 8.

Restrictions to shuffle trade flows

Steel trade flows into the EU are likely to change significantly in the coming years amid a shift toward green steel and as trade restrictions and decarbonization policies reshape global markets and limit imports from traditional sources.

Middle Eastern countries, including Saudi Arabia and Algeria, are expected to seize the opportunity to increase exports to the EU, while material from Turkey is already becoming a more popular option among European buyers.

The European Commission launched an anti-dumping (AD) investigation into hot-rolled coil (HRC) imports from Egypt, India, Vietnam and Japan on Thursday.

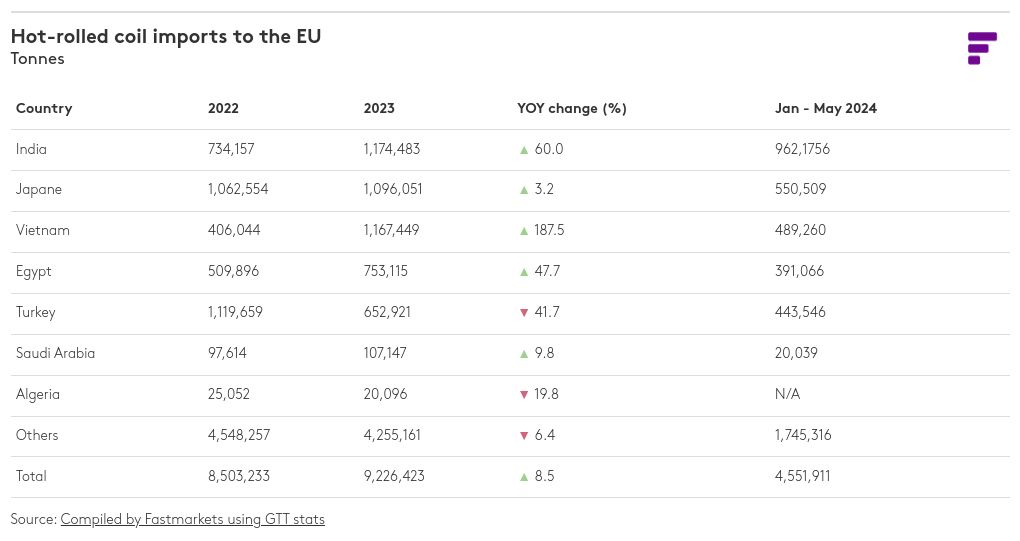

Combined, the four countries supplied 4.19 million tonnes of HRC to the EU in 2023 – about 45% of the total HRC import volumes.

And European buyers are now likely to book more domestic supplies and look for alternative sources of supply globally, market participants said.

Turkey has been increasing HRC deliveries to Europe again lately despite Turkish flat steel already being subject to an AD duty in the EU in relation to recently updated safeguard measures.

The EU considers Turkey the only “safe origin” for imported steel due to it having a sufficient individual quota that has never been fully utilized because of the availability of more competitive origins.

And if Asian HRC becomes a riskier proposition because of new safeguard measures, European buyers will be more interested in Turkish coil.

Turkey’s total allocation for the third quarter of 2024 is 475,173 tonnes, according to the European Commission. And, of that amount, 239,289 tonnes were still available as of August 8, with about 11,176 tonnes awaiting allocation.

In contrast, in the second quarter, Turkey’s allocation was 1.2 million tonnes – after unused volumes were transferred from the previous quarter. Of the total, 308,627 tonnes were not used.

Sources said, that price-wise, offers from Turkey were in line with, or only slightly higher than, those coming from Asia – even with the anti-dumping duty taken into consideration.

“Turkey has been become more active in the European market lately, with quicker shipments and a big quota, so for many European buyers it’s a safe import option,” a buyer in Italy said.

In January-May 2024, Turkish HRC imports to the EU amounted to 443,546 tonnes, compared with 652,921 tonnes for the entire year in 2023.

Turkey also has the advantage of lower freight costs because of its proximity to Europe and most of the HRC producers in Turkey are already EAF-based, which is beneficial in light of the EU’s CBAM regulations.

Both Saudi Arabia and Algeria now regularly export HRC to Europe – albeit mostly to Italy, Spain, and Portugal. And while the volumes up until now have not been particularly significant, sources said they now expect deliveries from these two countries to gradually increase.

“Saudi [Arabia] has no problems with quotas and we already see regular buying interest in [small volumes of] HRC from Saudi in the EU,” a buyer in Northern Europe said.

‘Green steel’ advantages of MENA suppliers

The steelmakers in MENA region have the benefit of renewable energy and the “cleaner” EAF and DRI-EAF steelmaking routes, which will provide the area with a big advantage over other regions when Europe’s CBAM comes into force.

CBAM is a tool intended by the EU to put a fair price on the carbon emitted during the production of any carbon-intensive goods that enter the bloc and the CBAM transition period began on October 1, 2023. During this phase, which runs until the end of 2025, the EU authorities will test the mechanism without imposing any duties, with full implementation to be phased in between 2026 and 2034.

The phasing-in of CBAM will coincide with the phasing-out of the free carbon allowances currently applicable under Europe’s Emissions Trading Scheme (ETS).

The price of carbon certificates for imported goods will be calculated by the European Commission on a weekly basis, based on the average price of the closing EU ETS carbon dioxide (CO2) allowances for each week.

The price of a carbon emissions permit in the EU was €65-70 ($71-76) per tonne this July, but market participants estimate that CO2 allowance prices will jump to €200-250 ($219-273) per tonne when the free allocations are phased out.

And once CBAM is fully phased in, MENA-based steelmakers will have an opportunity to crowd out more-carbon intensive Asian steel producers in the EU steel import market, sources said.

Steelmakers in South Korea and Japan, meanwhile, are already planning to import hot-briquetted iron (HBI), including from the Middle East, while also planning projects that will initially operate using fossil fuel gas before switching to green hydrogen as it gets cheaper.

But being relatively new to steelmaking, most MENA steelmakers are already several steps ahead because they do not need to make substantial investments to replace their base technologies.

Growing demand for green steel in Europe

Steel end users in Europe have already started signing contracts with green steel producers in the MENA region, in an apparent attempt to diversify their green steel supply sources, Fastmarkets understands.

Global carmaker Volkswagen, for instance, is planning to buy up to 300,000 tonnes per year of low-carbon steel from Oman’s Vulcan Green Steel (VGS) by 2027, with the two companies signing a Memorandum of Understanding (MoU) to that effect, the Germany headquartered car producer said in June.

In addition, members of the Gulf Cooperation Council are likely to have excess steel capacity and geographical advantages will allow for improved exports according to panelists speaking at Fastmarkets’ Middle East Iron & Steel Conference in November 2023.

Market participants continue to report mainly sporadic buying interest in green steel in Europe’s spot market, with transactions in most cases done directly between steelmakers and end users.

The automotive industry remains the primary buyer of green steel in Europe, but the construction sector in some regions has recently started showing an interest in purchasing greener steel, sources said, adding that wider interest in green steel will continue to rise in the coming years, supported by the EU regulations, with some steel mills having noticed “positive dynamics in green steel sales,” since 2023 – despite overall volumes still being limited.

“[One major European steelmaker] produced 200,000 tonnes of reduced-carbon [flat and long] steel in 2023 and aims to double that amount in 2024,” a second buyer source said.

Fastmarkets’ weekly assessment of the green steel domestic, flat-rolled, differential to HRC index, exw Northern Europe, was €170-250 per tonne on August 1, stable week on week.

Discover how our suite of green steel prices can support your ‘green’ investment decisions while bringing transparency to the industry. Find out more.