Global stock markets rallied Thursday as investors cheered bumper profits from US chip giant Nvidia, seen as the bellwether for artificial intelligence, with records falling in Asia, Europe and North America.

Highly anticipated results from Nvidia after the Wall Street close Wednesday saw the company post quarterly profit of $12.3 billion on record revenue, driven by demand for its AI-powering chips.

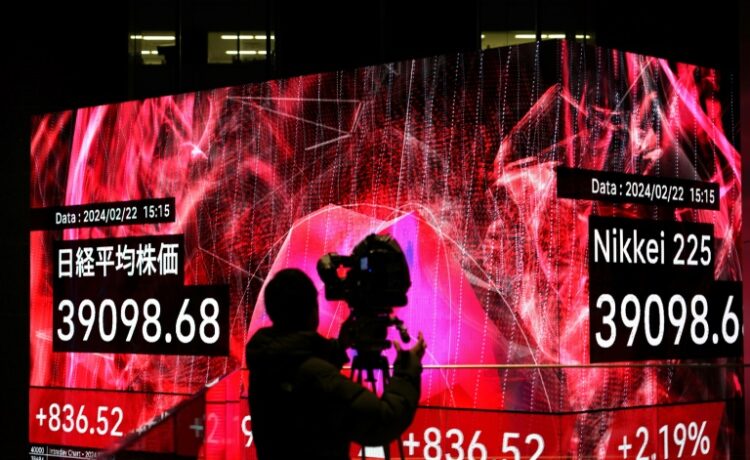

That touched off a broader rally in tech shares, sending Japan’s Nikkei 225 up 2.2 percent to end at an all-time high of 39,098.68 points, breaking a record high that had stood since 1989.

Eurozone indices also advanced Thursday with investors awaiting European Central Bank minutes of its most recent meeting on interest rates, with both Frankfurt and Paris striking new records.

Ahead of the release, a survey showed that eurozone business activity fell for a ninth month running, but the rate of decline eased further.

Some economists said the data showed the 20-nation single currency area was moving slowly towards recovery, while others said the figures mean the ECB will not cut interest rates soon.

The HCOB Flash Eurozone purchasing managers’ index (PMI), published by S&P Global, recorded a figure of 48.9 for February after 47.9 in January.

A figure below 50 indicates contraction, but this was the smallest rate of decline since June 2023.

Separate PMI data for Britain firmed belief that its economy could already be out of recession. Official data this month showed it had contracted in the second half of last year as high inflation weighed.

In the United States, minutes Wednesday from the Federal Reserve’s most recent policy meeting showed that officials were at odds on when to start cutting interest rates as inflation comes down.

“Policymakers are concerned about the potential risks of cutting interest rates too soon,” said Stephen Innes of SPI Asset Management.

But Wall Street’s main indices shot higher as trading got underway Thursday as tech optimism overshadowed concerns about the timing of interest rate cuts.

The Nasdaq Composite jumped over two percent and the S&P 500 struck a record high, with shares in Nvidia soared more than 15 percent to a new record high of $780.85 apiece.

Briefing.com analyst Patrick O’Hare said Nvidia’s results “have generated a halo effect that has put a shine on other semiconductor stocks, other AI stocks, and other growth stocks”.

– Key figures around 1630 GMT –

New York – Dow: UP 0.7 percent at 38,887.24 points

New York – S&P 500: UP 1.7 percent at 5,064.63

New York – Nasdaq Composite: UP 2.4 percent at 15,954.60

London – FTSE 100: UP 0.3 percent at 7,684.49 (close)

Paris – CAC 40: UP 1.3 percent at 7,911.60 (close)

Frankfurt – DAX: UP 1.5 percent at 17,370.45 (close)

EURO STOXX 50: UP 1.7 percent at 4,855.36 (close)

Tokyo – Nikkei 225: UP 2.2 percent at 39,098.68 (close)

Hong Kong – Hang Seng Index: UP 1.5 percent at 16,742.95 (close)

Shanghai – Composite: UP 1.3 percent at 2,988.36 (close)

Euro/dollar: DOWN at $1.0816 from $1.0817 on Wednesday

Dollar/yen: UP at 150.53 yen from 150.24 yen

Pound/dollar: UP at $1.2639 from $1.2630

Euro/pound: DOWN at 85.58 pence from 85.67 pence

West Texas Intermediate: UP 0.7 percent at $78.45 per barrel

Brent North Sea Crude: UP 0.6 percent at $83.50 per barrel

burs-rl/yad