Investors are anxiously waiting for Nvidia’s (NVDA) fourth-quarter earnings report, which may provide a much-needed boost to the U.S. stock market. However, the chipmaker’s results are also expected to have a significant impact on Asian AI stocks, according to Morgan Stanley. Indeed, the firm estimates that if Nvidia’s revenue beats expectations, Asian AI stocks could see price gains of 3-15%. On the other hand, if Nvidia’s revenue falls short, Asian AI stocks may decline by 5-10%.

Discover the Best Stocks and Maximize Your Portfolio:

Interestingly, though, Morgan Stanley’s global director of research, Katy Huberty, said that Nvidia’s Q4 earnings release “likely has a positive skew” for Asian tech stocks as share prices have been consolidating in the lead-up to the report. As a result of the excitement, volatility in Asian markets has increased, with the Hang Seng Index jumping 3.3% ahead of Nvidia’s report.

Nevertheless, despite the potential for short-term gains, some investors are questioning the long-term potential of Nvidia and the AI trade. In fact, Lee Munson, the president of Portfolio Wealth Advisors, believes that the AI energy trade has not played out as expected and is now shifting his focus to software companies that can provide AI productivity tools. More specifically, Munson likes firms such as Salesforce (CRM), which he believes has significant growth potential in the AI software trade.

Is NVDA a Good Stock to Buy?

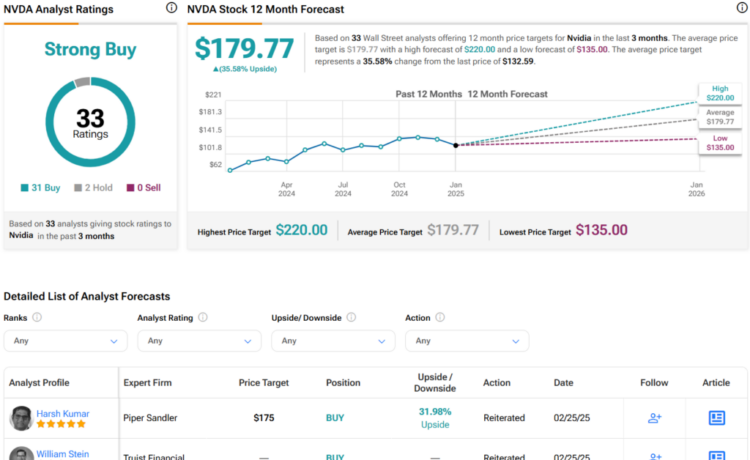

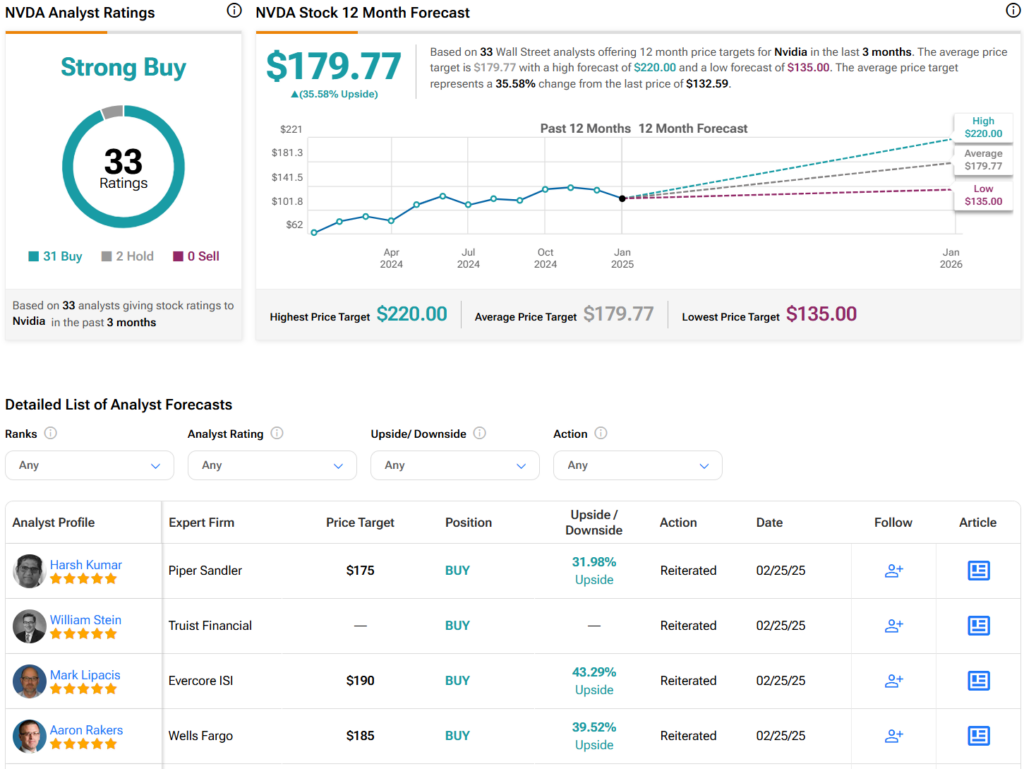

Overall, analysts remain bullish on NVDA stock, with a Strong Buy consensus rating based on 31 Buys and two Holds assigned in the past three months. After a 69% rally in its share price over the past year, the average NVDA price target of $179.77 per share implies an upside potential of 35.6% from current levels.

Source link