Late last month, S&P Global Ratings raised its outlook for India’s sovereign rating, citing expectations of “deepening economic reforms”. It’s reasonable to think S&P analysts are back at the drawing board.

Oanda analyst Kelvin Wong spoke for many recently when he noted green shoots in China’s factory purchasing managers’ activity. “This latest set of positive macro data suggests the piecemeal stimulus measures from China’s top policymakers are working to negate the deflationary risk spiral that has been triggered by the significant slowdown inherent in the domestic property market,” he said.

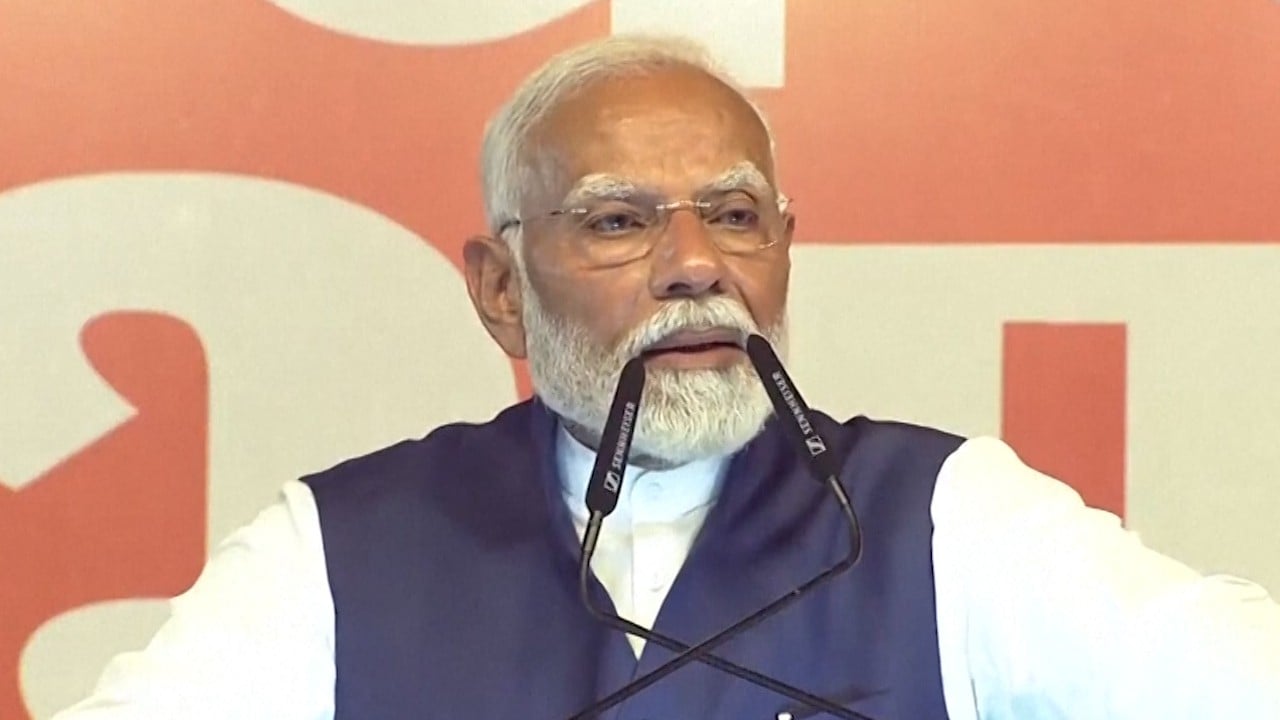

Again, there are myriad reasons to worry that Xi’s inner circle will overpromise and underperform. But the great China vs India debate might once again be pivoting back China’s way as strongman Modi suddenly has to play nice with opposition lawmakers.

At a minimum, Modi and his alliance partners will clash over his Hindu nationalist policies, distracting New Delhi from economic retooling.

Had the BJP won a clear and resounding mandate, investors might have more confidence in Modi’s third term being a charm for raising India’s economic game. This is now in doubt – just as China makes progress in altering its economic narrative while Modi’s gets old.

William Pesek is a Tokyo-based journalist and author of “Japanization: What the World Can Learn from Japan’s Lost Decades”