YURI KAGEYAMA, Associated Press

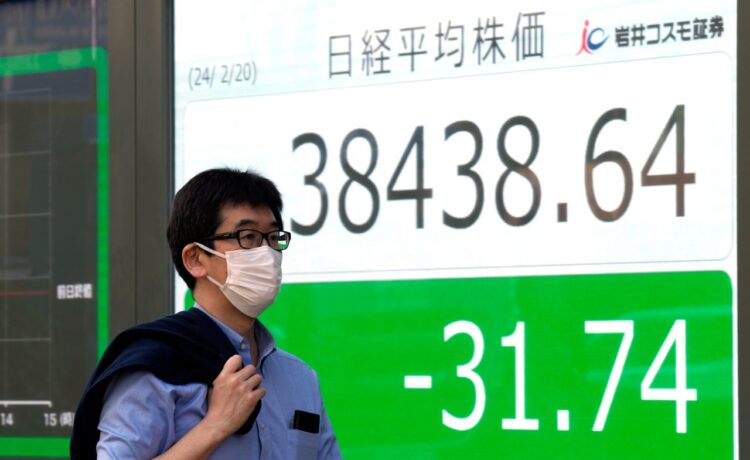

A person walks in front of an electronic stock board showing Japan’s Nikkei index at a securities firm Tuesday, Feb. 20, 2024, in Tokyo. Asian shares were trading mixed Tuesday a day after Chinese markets reopened from a long Lunar New Year holiday. (AP Photo/Eugene Hoshiko)

TOKYO (AP) — Global shares were trading mixed Tuesday on the second day Chinese markets were open after the Lunar New Year break.

France’s CAC 40 added 0.3% in early trading to 7,788.86, while Germany’s DAX dipped 0.3% to 17,047.67. Britain’s FTSE 100 was little changed, inching up less than 0.1% to 7,732.31. U.S. shares were set to drift lower with Dow futures slipping nearly 0.2% to 38,621.00. S&P 500 futures were down 0.2% to 5,007.50.

Wall Street trading was closed Monday in the United States for President’s Day. Investors were generally turning less optimistic because of expectations that higher interest rates would likely kick in soon.

China’s central bank kept its 1-year loan prime rate unchanged on Tuesday but cut its 5-year rate by 25 basis points to 3.95%. That came as a surprise, the first time the five-year rate was cut since May 2023.

“The cut to the five-year LPR is likely aimed at supporting the recovery of the property market, and could improve affordability for buyers by lowering the mortgage rates,” said Lynn Song, chief economist at ING.

Benchmarks rose in China, but slipped in Tokyo, Sydney and Seoul.

Hong Kong’s Hang Seng gained 0.6% to 16,247.51, while the Shanghai Composite rose 0.4% to 2,922.73.

Japan’s benchmark Nikkei 225 declined 0.3% to finish at 38,363.61.

Australia’s S&P/ASX 200 slipped less than 0.1% to 7,659.00. South Korea’s Kospi lost 0.8% to 2,657.79.

A recent U.S. report on inflation at the wholesale level has indicated that rising prices still continues. Such data tend to squelch hopes that the Federal Reserve could begin cutting interest rates in March.

In energy trading, U.S. benchmark crude added 6 cents to $79.25 a barrel. Brent crude, the international standard, shed 28 cents to $83.33 per barrel.

In currency trading, the U.S. dollar rose to 150.32 Japanese yen from 150.10 yen. The euro cost $1.0778, down from $1.0783.