(Bloomberg) — A wild week in markets is ending on a subdued note, with Friday trading seeing light equity volumes and small moves across stocks, bonds and currencies.

Most Read from Bloomberg

US stocks are close to wiping out all the losses from the Monday’s market meltdown, with S&P 500 futures indicating a 0.2% gain at the open. European stocks are already positive on the week as investors hunted for bargains from the selloff. Treasury yields dipped and the dollar weakened. The VIX Index hovered around 23.

US stock markets roared back on Thursday as data showed fewer American filing for jobless benefits, which helped alleviate fears of a recession. The S&P 500 has narrowed its loss for the week to just 0.5%. Investors will be waiting for next week’s data, which includes reports on US consumer inflation retail sales.

“Market volatility could remain elevated for some time,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. But “investors shouldn’t overreact to swings in market sentiment,” he said.

In premarket trading, Expedia Group Inc. surged after posting better-than-expected second-quarter results. Paramount Global rose as much as 7.1% after beating profit estimates.

Mixed signals from US central bank officials may prompt caution among investors. Federal Reserve Bank of Kansas City President Jeffrey Schmid indicated he’s not ready to support a reduction in interest rates with inflation above the target, according to comments made on Thursday in the US.

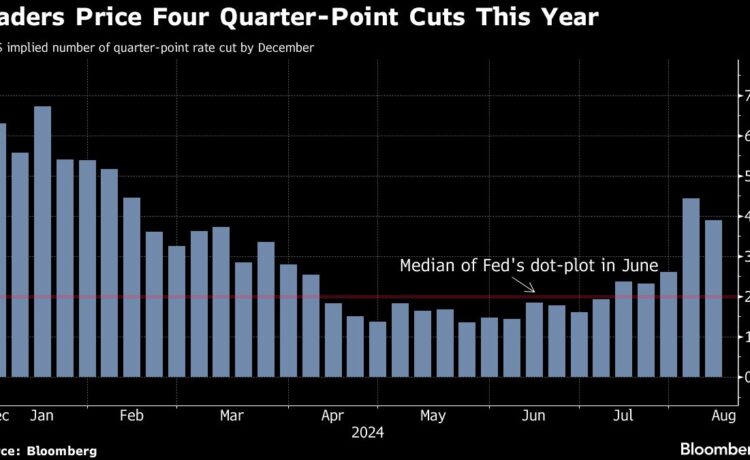

Swap traders further trimmed bets on aggressive Fed easing in 2024. The global repricing has been so sharp that at one point interest-rate swaps implied a 60% chance of an emergency rate cut by the Fed in the coming week — well before its next scheduled meeting in September. Current pricing suggests about 40 basis points of cuts for September.

“Scope for higher bond yields is limited as central banks may have realized it’s time to move back to more neutral settings,” said Martin van Vliet, a macro strategist at Robeco. “This scare will will have reinforced the feeling among central banks that they need to take back the restrictiveness of monetary policy.”

The Stoxx Europe 600 index climbed 0.8%, led by real estate and miners. Hargreaves Lansdown Plc gained after a consortium including CVC and ADIA agreed to buy the investment manager in a £5.4 billion ($6.9 billion) deal.

Trading volumes in European stocks were about 35% below average levels on Friday, according to data compiled by Bloomberg.

Carry Concerns

In Asia, the stock rally lost some momentum as the yen temporarily resumed its rise. Japan’s Topix index narrowed its gain to 0.9% from as much as 2% earlier. Chinese shares turned flat after an earlier advance as perceptions grew that a better-than-expected inflation print mainly resulted from seasonal factors like weather.

Unwinding of carry trades has further room to run and short-yen positions will continue to be slashed as the Japanese currency strengthens, according to Bob Savage, head of markets strategy at BNY Mellon Capital Markets. Investors are still too bearish on the yen, which could advance toward 100 per dollar over time, he said.

Oil was steady following a Thursday rally, against the backdrop of simmering tensions in the Middle East. Gold slipped.

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.1% as of 6:17 a.m. New York time

-

Nasdaq 100 futures rose 0.3%

-

Futures on the Dow Jones Industrial Average were little changed

-

The Stoxx Europe 600 rose 0.7%

-

The MSCI World Index rose 0.2%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.1%

-

The euro was little changed at $1.0920

-

The British pound was little changed at $1.2754

-

The Japanese yen was little changed at 147.17 per dollar

Cryptocurrencies

-

Bitcoin rose 2.1% to $60,783.56

-

Ether rose 3.4% to $2,657.91

Bonds

-

The yield on 10-year Treasuries declined three basis points to 3.96%

-

Germany’s 10-year yield declined three basis points to 2.24%

-

Britain’s 10-year yield declined three basis points to 3.94%

Commodities

-

West Texas Intermediate crude rose 0.2% to $76.32 a barrel

-

Spot gold fell 0.1% to $2,424.12 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Sagarika Jaisinghani, Chiranjivi Chakraborty, Sujata Rao and Alice Gledhill.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.