Stock market crash: Domestic institutional investors (DII) bought ₹9,093.72 crore worth of shares on March 13 (Wednesday) as Sensex and Nifty witnessed huge selling pressure. Foreign institutional investors (FII) sold ₹4,595.06 crore, as per data from the stock exchanges.

What happened in the trading session?

In the trading session, DIIs bought shares worth ₹20,267.90 crore and sold ₹11,174.18 crore worth of shares while FIIs bought ₹33,223.63 crore worth of equity while they sold ₹37,818.69 crore worth of shares.

What is the buying and selling trend in March so far?

So far in March, FIIs bought ₹9,818.97 worth of shares. DIIs have bought ₹28,589.28 worth of equity and have been net sellers only on March 2 when they sold ₹44.71 crore worth of shares, data showed.

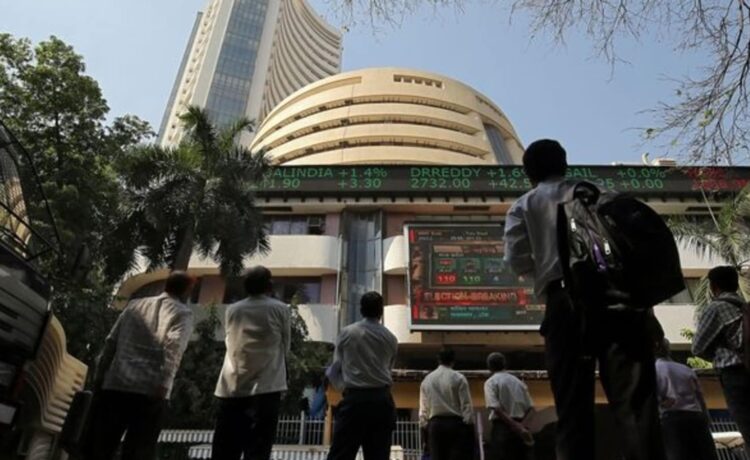

What happened at the stock markets?

Benchmark indices were under pressure as Sensex closed down 906.07 points or 1.23 per cent at 72,761.89.

Nifty 50 was down 338.00 points or 1.51 per cent at 21,997.70 and BSE Midcap and BSE Smallcap indices were down 4 and 5 per cent, respectively. The stock market crash comes after Sebi chairperson Madhabi Puri Buch gave a froth warning on smallcaps and midcaps, saying, “There are pockets of froth in the market. Some people call it a bubble, some may call it froth. It may not be appropriate to allow that froth to keep building.”

Stay informed on Business News along with Gold Rates Today, India News and other related updates on Hindustan Times Website and APPs