‘When US treasuries sneeze, UK government bonds catch a cold’published at 13:08 British Summer Time

Michael Race

Michael Race

Senior economics and business reporter

The US bond market has been rocked by the introduction of tariffs as investors dumped US government debt yesterday, signalling that confidence in the US economy was faltering.

Governments sell bonds – essentially IOUs – to raise money from investors and return they pay interest. During times of global economic turbulence, investors usually look to buy US bonds as they feel they are a safe investment (safe haven) for their money and the US economy can be relied upon.

But that didn’t happen yesterday.

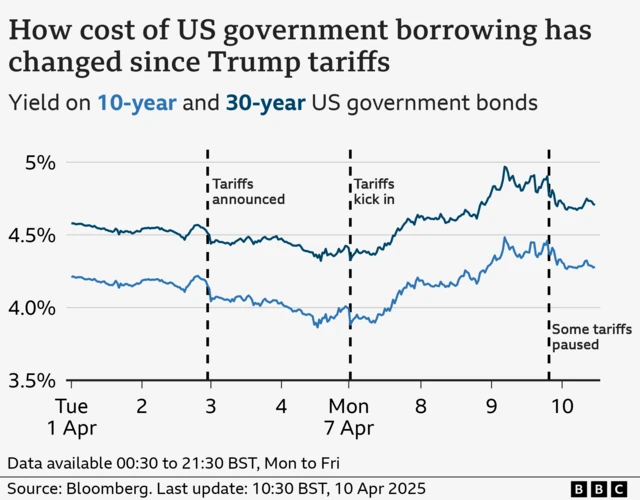

Instead investors began selling off their bonds and as demand for them fell over fears tariffs would push up inflation and affect returns, the interest rate (or yield) the US government pays to borrow money shot up sharply.

“Bond investors demand higher yields when they think inflation might erode their income,” says Jeffrey Cleveland, chief economist at the US investment adviser Payden and Rygel.

That poses a big problem for the world’s biggest economy as rising interest on bonds ultimately means higher costs for companies to borrow – if businesses can’t get access to credit, that can halt economic growth and lead to job losses over time.

And as one economist put it yesterday “when US treasuries (bonds) sneeze, UK government bonds catch a cold” – that played out as UK government borrowing costs jumped.

Since Trump has paused some higher tariffs on countries, the US bond market has settled somewhat, but the interest rate/yield on US government borrowing over 30 years, for example, remains higher (4.7%) than it was at the start of the week (4.3%).

A shift of anything above 0.2% is considered big.