Stocks in Asia were mixed overnight as the yen rose after Bank of Japan governor Kazuo Ueda signalled it is still on the path to raise interest rates.

The Japanese currency rose as much as 0.7% against the dollar, while government bond futures fell.

In replies to politicians, Ueda said the BOJ’s stance had not changed, provided inflation and economic data continue in line with its forecasts.

The comments come after his deputy had sought to reassure markets that further hikes would also depend on the state of the market, after the central bank’s increase in July trigger a massive selloff in global equities.

The Nikkei (^N225) rose 0.4% on the day in Japan, while the Hang Seng (^HSI) fell 0.2% in Hong Kong. The Shanghai Composite (000001.SS) was 0.2% down by the end of the session.

It came as Japanese inflation data exceeded forecasts. Consumer prices in July rose 2.8% from a year earlier, the same as the prior month and higher than the 2.7% expected by economists.

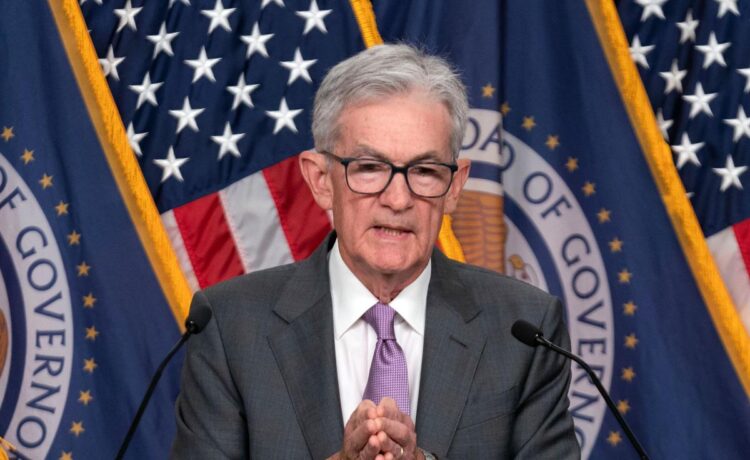

Meanwhile, equities in Hong Kong, Australia and South Korea declined, echoing Thursday’s selloff in the US as traders wait on Federal Reserve chair Jerome Powell’s Jackson Hole speech later on Friday.

Across the pond on Wall Street, all three major American stock indexes lost ground last night, weighed down by technology shares, as US Treasury yields rose on easing recession fears.

The Dow Jones Industrial Average (^DJI) fell 0.4%, to 40,712.78. The S&P 500 (^GSPC) lost 0.9%, closing at 5,570.64, and the Nasdaq (^IXIC)dropped 1.67pc, to 17,619.35.

The yield on benchmark 10-year US Treasury bonds rose to 3.86% from 3.80% late on Wednesday.