Wall Street followed the FTSE 100 (^FTSE) higher on Thursday even as the number of Americans claiming unemployment benefits increased more than expected last week.

According to government figures, initial jobless claims rose to a seasonally adjusted 221,000 for the week ending on 30 March, official figures showed.

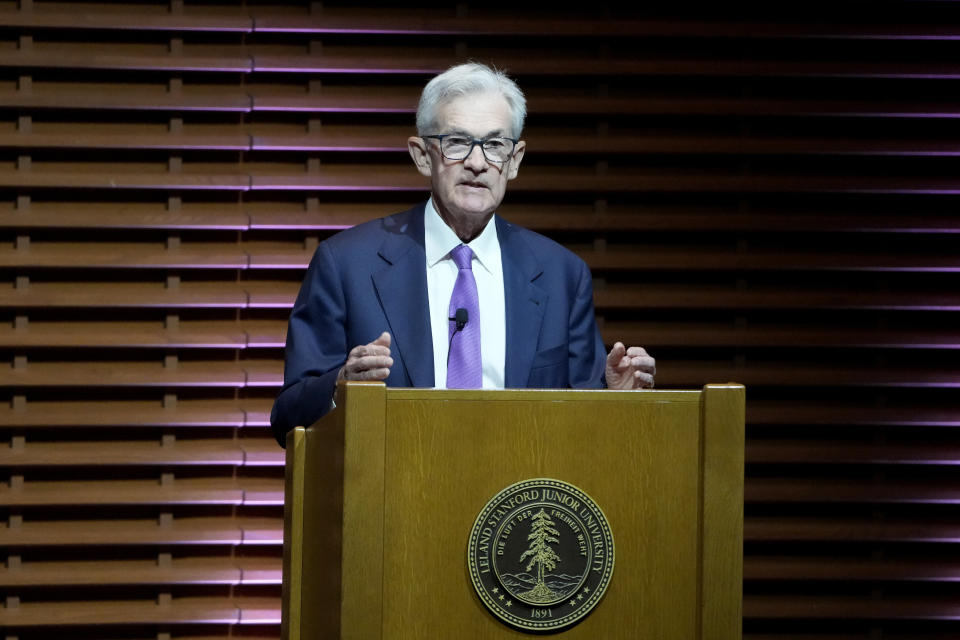

It came after comments from Federal Reserve chair Jerome Powell failed to alter the mood regarding interest rates. He expects rates will fall at some point this year, but said that policymakers need more evidence that inflation is on a sustainable path back to 2%.

Deutsche Bank reported that investors are pricing in a 64% chance of a rate cut by June, with 71 basis points of easing seen by the end of the year.

Traders will also be looking to the latest minutes from the European Central Bank’s (ECB) March meeting.

-

London’s benchmark index was 0.5% higher by the end of the session, with banks and miners leading the charge

-

Germany’s DAX (^GDAXI) was 0.2% higher and the CAC (^FCHI) in Paris was flat at the close

-

The pan-European STOXX 600 (^STOXX) was up 0.2% during the session

-

Wall Street opened higher as the US dollar ceded ground to other major currencies

-

Ocado chair Rick Rick Haythornthwaite set to leave boardroom role early next year

-

Moody’s cuts Thames Water debt rating

Pierre Veyret, technical analyst at ActivTrades, said: “While optimism is returning to the market, investors will cautiously monitor the next batch of data for this week, including today’s PMI and PPI data from the Eurozone and the initial jobless claims from the US.”

“In addition, several speeches from Fed officials alongside the publication of the minutes of the last ECB meeting may also bring higher market volatility throughout the day ahead of tomorrow’s US Non-Farm Payroll.”

Follow along for live updates throughout the day:

Live22 updates

-

Market close and recap

Well that’s all from us today, thanks for following along as always. Be sure to join us again tomorrow for more.

Here’s a quick recap of some of the top stories from today:

-

UK business activity grows again

-

PMI: Input prices continue to rise sharply

-

SMMT: new car sales surge

-

Profits at Co-op slide

-

Number of Americans claiming unemployment benefits rise

-

Oil prices rise on lower supply concerns

-

Bet365 fined for money laundering failures

Have a good evening all!

-

-

Amazon to cut hundreds of jobs in cloud computing

Amazon has announced it is cutting hundreds of jobs in its cloud unit, Amazon Web Services (AWS).

An AWS spokesperson said, in a statement to news organisations:

These decisions are difficult but necessary as we continue to invest, hire, and optimize resources to deliver innovation for our customers.

The firm added that it will continue to hire in other priority areas and that it has thousands of AWS job openings posted online.

It has not been confirmed in which countries the layoffs will happen, but Amazon is seeking to find internal opportunities for employees whose roles are affected.

-

Inflation to fall to 1.2% in June before rising again

UK inflation is set to fall to 1.2% in June before rising again before the end of the year, HSBC said on Thursday.

The lender said that the pace of price rises is expected to decline sharply as a result of the fall in the Ofgem price cap on energy bills in April, as well as from the passing of statistical “base effects.”

It comes as inflation has dropped from 11.1% in October 2022 to 3.4% in February 2024.

HSBC said:

“To be clear, we do not see a re-acceleration in cost and price pressures ahead.

“But we are assuming a degree of persistence in our forecast such that, after the energy-driven dip this year, UK inflation will pop back slightly above 2pc later this year, before only reaching the target mark on a more ‘sustainable’ basis next year.”

-

UK’s best selling cars revealed

The Nissan Qashqai was March’s best-seller with 8,931 registrations, and is the second best selling car in the UK this 2024 with 14,555 sales year-to-date.

The Ford Puma was the second best selling car last month with 8,318 cars hitting the roads. However, year to date this is the UK’s number one car, with 15,054 units sold.

The Kia Sportage was third with 7,445 cars sold.

The Nissan Juke was number four on this list, with 7,346 units sold, followed by the Audi A3, with 6,010 registrations.

The Vauxhall Corsa (5,952), Mercedes-Benz A-class (5,892), Volkswagen Golf (5,631), Tesla Model Y (5,602), and the MG HS (5,460) complete the top 10 best sellers in March.

-

Number of Americans claiming unemployment benefits rise

Charlotte North Carolina,Starbucks Coffee,sign notice banner,help wanted now hiring apply online,jobs economy,Black African,ethnic ethnicity,minority, (Jeffrey Isaac Greenberg 12+) The number of Americans claiming unemployment benefits increased more than expected last week, new data has shown.

According to government figures, initial jobless claims rose to a seasonally adjusted 221,000 for the week ending on 30 March.

A Reuters poll of economists showed an average forecast of 214,000 claims.

Reuters reported:

Labour market resilience is anchoring the economy, with gross domestic product increasing at a brisk 3.4% annualized rate in the fourth quarter. Growth estimates for the first quarter are as high as a 2.8% pace.

That strength, combined with still-high inflation, could see the Federal Reserve delaying a much-anticipated interest rate cut this year.

It came as the US trade deficit in February was slightly bigger than expected, coming in at $68.9bn, this was $1.6bn more than economists had forecast.

Initial claims for the week ending March 30, 2024, indicates that the remarkable job security experienced by Americans continues into the second quarter of 2024. First time claims increased to 221,000 from an upwardly revised 212,000 during the previous week which is modestly… pic.twitter.com/46jCGztGw2

— Joseph Brusuelas (@joebrusuelas) April 4, 2024

-

Gold hits record high

Gold continues to shine today with the precious metal hitting a fresh record high, nearing $2,300 an ounce in Thursday trading. It has since fallen 0.4% at the time of writing.

Nigel Green of deVere Group said:

“The surge in gold prices to unprecedented levels has captured the attention of investors worldwide.

“The common narrative attributes this surge to geopolitical tensions and expectations of interest rate cuts by the US Federal Reserve.

“It’s certainly true that the Russia-Ukraine war and conflicts in the Middle East, have contributed to the uncertainty plaguing global markets.

“Investors traditionally flock to gold during times of geopolitical turmoil, perceiving it as a safe-haven asset that retains value even in turbulent times.

“Similarly, expectations of interest rate cuts by the US Federal Reserve diminishes the opportunity cost of holding gold, further enticing investors to enter the market.”

-

British ISA could boost UK tax-free savings by £59bn

Analysis by peer-to-peer real estate investment platform, easyMoney, reveals that the government’s proposed British ISA could add a potential £59bn to the UK savings landscape.

During the recent Spring Budget, the UK government announced plans to introduce a new British ISA which will give UK savers an additional tax-free ISA allowance of £5,000 in addition to the existing £20,000 allowance, with which they can invest in UK-focused assets.

easyMoney has analysed the most recent ISA savings data to understand how ISA investment has changed over the past year, and how much additional investment capital could potentially be created by the new British ISA.

The analysis reveals that:

-

Overall ISA investment in the UK has fallen. Provisional figures for the year 2021-22 (latest available data) reveals that the number of ISA account subscriptions has fallen by -3.8% on the year to sit at a current total of 11.75 million.

-

Total ISA savings currently come to £67 billion. This marks an annual drop of -7.3%, while average investment per ISA account has fallen by -3.7% to sit at £5,696.

-

However, this decline in ISA savings has been driven largely by a reduction in traditional Cash ISA investment for which the number of subscriptions has fallen by -11.4% on the year. As a result, the level of total investment in Cash ISAs has also fallen by -16%, with average investment per subscription down by -5.2%.

-

-

Wall Street set to open higher as dollar slips

Wall Street is set to lower higher today as the US dollar loses ground to a basket of other currencies.

Ricardo Evangelista, senior analyst at ActivTrades, said:

“The US dollar ceded ground to other major currencies during early Thursday trading.”

“The release of US services data, indicating lower-than-expected growth, drew investors’ attention to this Friday’s employment data, poised to sway the Federal Reserve’s decision on whether to initiate rate cuts in June or later.”

“The US central bank’s decision-making remains contingent on data, as reiterated by Chairman Jerome Powell during a recent public address.

Against this backdrop, Friday’s employment figures will shed further light on the state of the underlying US economy and could solidify traders’ expectations regarding the timing of the first Fed rate cut, likely prompting corresponding reactions from the dollar.”

-

Bitcoin price volatile as reduction in supply looms

Bitcoin is experiencing price volatility with just over two weeks remaining before the digital asset is expected to undergo its “halving” event.

Bitcoin halving means the reward for mining bitcoin is cut in half. Halvings reduce the rate at which new coins are created and therefore lower the available amount of new supply. Bitcoin (BTC-USD) last halved on May 11, 2020, resulting in a block reward of 6.25 BTC. The next halving will bring the block reward down to 3.125 BTC.

Frantic trading in the lead up to the event has driven up the price of bitcoin, with volatility over the past 24 hours causing the digital asset to fall to $65,000 (£51,340), before subsequently recovering to currently trade slightly above $66,000 (£52,130).

Although the forthcoming bitcoin halving is expected to decrease the supply of bitcoin, potentially resulting in price appreciation, recent market trends indicate that investors may be cashing in on profits ahead of the event.

This was evidenced by a significant drop in bitcoin’s price at the beginning of the week, plummeting from nearly $70,000 (£55,290) to slightly above the $65,000 threshold.

-

Demand for EVs slows sharply

Staying with the car industry…

The UK government has been urged to offer incentives for people to buy electric cars after new figures showed a decline in the market share of EVs.

Only 15.2% of new cars registered in March were pure electrics, down from 16.2% during the same month last year, the Society of Motor Manufacturers and Traders (SMMT) said.

The industry body said the government needed to halve VAT on the purchase of new electric vehicles (EVs), amend plans to introduce vehicle excise duty for EVs, and reduce VAT on public EV charging to bring it into line with home charging.

Under the Zero Emission Vehicle (ZEV) mandate, at least 22% of new cars sold by each manufacturer in the UK this year must be zero-emission, which in most cases means they are pure electrics.

The threshold will rise annually until it reaches 100% by 2035.

SMMT chief executive Mike Hawes said:

Manufacturers are providing compelling offers, but they can’t single-handedly fund the transition indefinitely.Government support for private consumers – not just business and fleets – would send a positive message and deliver a faster, fairer transition on time and on target.

-

SMMT: new car sales surge

The latest SMMT data is in — let’s take a look at the key findings:

-

New car registrations rise 10.4% in best March since 2019 and 20th consecutive month of growth.

-

Overall increase driven by fleet investment with weak confidence constraining private retail demand.

-

Industry calls for EV incentives with battery electric car market off the pace.

The UK new car market clocked up its 20th consecutive month of growth in March, with a 10.4% rise in registrations. In what is typically the busiest month of the year due to the new number plate, 317,786 new cars reached the road with a 24 plate – the best March performance since 2019, although still 30.6% below pre-pandemic levels

James Hosking, managing director of AA Cars said:

“March isn’t just the busiest month of the year for new car sales, it’s also a crucial test of both buyer confidence and the strength of the motoring sector.

“March’s sales figures may not have smashed a 20-year record like those seen in February, but they nevertheless reveal a market that’s firing on all cylinders. While sales to private buyers dipped, fleet sales jumped nearly 30% compared to the same month last year.

“With inflation cooling, and many people now seeing their earnings rise faster than the cost of living, Britain’s drivers are slowly feeling more confident about their personal finances. This confidence is having a decisive impact on demand, but dealers and manufacturers too have played a key role in the market’s strong start to 2024.”

-

-

What’s Next for Thames Water?

Henley on Thames, Oxfordshire, UK. 28th February, 2024. Bell Street in Henley, Oxfordshire is currently closed to traffic whilst Thames Water do work on water pipes. Thames Water has reportedly been lobbying the government and water regulator OFWAT to let it increase customer bills by 40%. They are also asking to be able to pay lower fines for pollution incidents so as to try to avert a bailout by taxpayers. Credit: Maureen McLean/Alamy Live News (Maureen McLean) The UK’s largest water utility lost a much-needed lifeline to stay afloat.

On 28 March 28, Thames Water Utilities Limited (Thames Water), a provider of water and wastewater services to more than 16 million customers across London and South East England, announced that its shareholders will not be providing a planned GBP 500 million equity injection.

Absent this funding, Thames Water’s parent, Kemble Water Utilities Limited (Kemble Water), had noted in its 2023 annual report that it would be unable to meet a £190m debt maturity at the end of April, while Thames Water would only have enough liquidity to meet its day-to-day operations for up to 18 months.

Key highlights ffrom Morningstar include:

-

Thames Water’s debt is substantial and, combined with penalties for missing set environmental targets, financial performance has been battered.

-

If Kemble Water defaults on its debt, negative investor sentiment in the UK water business may raise sector funding costs.

-

We do not, at this time, believe other UK water utilities are likely to become financially distressed as their shareholders have supported turnaround plans.

Tom Li, senior vice president, energy & natural resources of Morningstar DBRS, said:

“In the event Kemble Water defaults on its £190m debt obligation in April, investor sentiment in the UK water sector could turn negative and sector funding costs could rise.

“Furthermore, customer bills for other UK water utilities could increase materially as they have requested significant hikes to fund their proposed business plans too.”

-

-

European IPO issuance posts strongest Q1 since 2021

Proceeds raised from European IPOs in the first quarter of 2024 quadrupled year-on-year making it the strongest Q1 since the record breaking 2021.

This is according to figures from PwC’s latest IPO Watch EMEA, raising confidence that the IPO market will stage a recovery.

In Q1 2024 there were 13 IPOs in Europe raising €4.8bn, an increase of €3.6bn from the same period last year that saw €1.2bn raised from 10 IPOs.

Activity has also increased from the last quarter – Q4 2023, which saw €1.1bn raised from 16 listings.

Notable IPOs from the first quarter of the year include the €2.0bn IPO of skincare company Galderma on the SIX Swiss Exchange, the €889m IPO of consumer company Douglas on the Deutsche Borse and the €742m IPO of Athen International Airport on the Athens Stock Exchange.

The London IPO market

The first quarter of the year saw the proceeds raised from IPOs on the London Stock Exchange increase to £0.3bn from £0.1bn in Q1 2023.

However, a strong pipeline and regulatory changes aimed at increasing the attractiveness of listings are due to come into effect this year.

Q1 2024 also saw significant secondary market transactions, including the £1.9bn offering of LSEG shares, comprising a placing and a directed buyback, indicating robust demand for quality stocks on the LSE.

Kat Kravstov, capital markets director at PwC UK, said:

“Recent European IPO activity and the largely positive aftermarket performance suggests we are entering a recovery phase of the IPO market. Diversified pipeline, strong market performance and low volatility continue to support a second half weighted IPO window with quality and valuation driving the investment decision.

“EMEA as a whole has seen a promising start to the year, further encouraging optimism around the market and with the macroeconomic outlook looking more positive, the environment for companies with their sights on launching a European IPO later in the year is largely positive.”

-

Google to charge for premium AI-powered content

Google (GOOGL) has caught investors and users by surprise after reports that it could charge users for some of its AI-related services in what would be the biggest shake-up of its commercial model.

According to the Financial Times, it is looking at whether to add certain AI-powered search features to its premium subscription services which already offer access to its new AI assistant called Gemini, Google’s version of the chatbot ChatGPT.

The search giant, which is owned by Alphabet, has never before put any of its core products behind a paywall.

Executives have reportedly not yet made a decision when or whether to move ahead with the technology but the FT said engineers were developing the know-how needed to deploy the service.

Alphabet’s shares dipped about 1% in premarket trade.

-

Profits at Co-op slide

Co-op store mural, Curzon Street, Birmingham, West Midlands, England, UK (Colin Underhill) Co-op has posted a decline in annual pre-tax profit after the sale of its petrol forecourt business, citing grocery price inflation and rainy weather affecting convenience shopping.

The group, which runs Britain’s seventh-biggest supermarket chain, said profit before tax came in at £28m ($35.4 million) for 2023, compared with £268m pounds in the preceding year.

Meanwhile, group revenue fell £200m to £11.3bn.

It ended last year with a grocery market share of 5.4%, according to researcher Kantar, down 20 basis points on the year.

Co-op is owned by its more than 5 million members, and has been grappling with intense competition from German discounters Aldi and Lidl, as well as market leaders in the country.

There was also a sharp reduction in group net debt to £82m, from £322m the prior year.

Co-op has committed to investing millions of pounds to prevent price rises at the cost of profitability.

It comes as Co-op sold its petrol forecourt estate to supermarket rival Asda for more than £600m pounds in 2022. Excluding the business, profit was up £79m pounds for the year, it said.

-

PMI: Input prices continue to rise sharply

Continuing with the PMI data…

Input prices continued to rise sharply, with inflation rates only slightly below their six-month average. The primary factors contributing to the uptick was higher salary payments and increased transportation bills.

The rate at which prices charged by service providers have increased slowed to its lowest point since September 2023.

Despite this fall, the index remains well above its long-term trend, signalling enduring inflationary pressures within the UK’s domestic economy.

-

UK business activity grows again

The UK services industry grew for a fifth consecutive month last month in a sign that the economy is on its way out of recession.

According to the S&P Global UK Services PMI, March’s reading came in at 53.1.

Although this was down from 53.8 in February, and the slowest rate of business activity expansion since November, it was still above the 50 mark which separates growth from contraction.

Tim Moore, economics director at S&P Global, said:

Business activity has now expanded for five consecutive months, supported by sustained improvements in new order intakes. The solid growth rate achieved in March reinforces the view that a rebound in service sector performance is helping the UK economy to pull out of last year’s shallow recession.

Survey respondents once again commented on a turnaround in business and consumer spending, despite constraints on clients’ budgets from strong inflation and elevated borrowing costs.

-

Best UK mortgage deals of the week

Average mortgage rates are unchanged from the previous week but overall homeowners are still struggling to find a decent mortgage rate.

The average rate on a two-year fixed deal this week stood at 5.74%, while for a five-year deal, rates came in at 5.24%, according to figures from Uswitch.

The market appears to be volatile, as the higher costs providers are paying to fund mortgage lending have pushed many lenders to axe some of the cheaper deals.

This follows the Bank of England’s (BoE) decision to leave UK interest rates on hold at their current 16-year high of 5.25% for a fifth consecutive time.

Uswitch mortgage expert Kellie Steed said:

“Another mixed week in terms of lenders mortgage rate decisions. With the bank rate static at 5.25% and swap rates showing some volatility, we’ve again seen some lenders reduce rates and others raise them. As a result, average rates have remained fairly static.

“Predicting the direction of travel for mortgage rates in the coming weeks is, therefore, fairly difficult. Even Bank of England policymakers don’t seem to be on the same page at the moment.

In separate interviews, BoE monetary policy committee member, Catherine Mann, has suggested that financial markets are currently pricing in “too many rate cuts”. On the other hand, BoE governor Andrew Bailey, said it was ‘reasonable that markets are taking the view’ that there will be two to three base rate cuts later this year.”

-

Bet365 fined for money laundering failures

Bet365 has been fined £582,120 for anti-money laundering and social responsibility failures at its online business.

The Gambling Commission revealed that the company failed to carry out “meaningful” checks on potentially vulnerable customers during an assessment carried out in March 2022.

The firm had not carried out financial sanctions checks on new customers, the review found.

Kay Roberts, executive director of operations at the Gambling Commission, said:

The policy and procedural failings may not have been as severe as those at other gambling businesses in recent years but they were failings nonetheless.We expect high standards from operators in terms of keeping gambling safe, fair and crime-free, and will always take action to correct any failings. This operator is very aware that a repeat of these failings will result is escalating regulatory action.

-

Oil prices rise on lower supply concerns

Vole Au Vent Offshore supply ship Jack up rig anchored in the North sea off Blyth at sunrise with golden topped clouds and sun just above (Wilf Doyle) Oil prices rose slightly on Thursday, before paring back gains, on concerns of lower supply. It came as major producers are keeping output cuts in place and on signs of stronger economic growth in the US, the world’s biggest oil consumer.

Brent futures (BZ=F) for June rose 4 cents to $89.39 a barrel while US West Texas Intermediate (WTI) futures for May rose 2 cents to $85.45 a barrel.

On Wednesday, the Organisation of Petroleum Exporting Countries and its allies (OPEC+), decided to keep their oil supply policy unchanged. They also pressed some countries to boost compliance with output cuts.

Both the June Brent contract and the May WTI contract have risen for the past four days and closed on Wednesday at the highest since the end of October.

Analysts at ING said:

“Brent is facing some resistance at the US$90/bbl level, with it unable to break above it so far.”

Watch: How does inflation affect interest rates?

Download the Yahoo Finance app, available for Apple and Android.