Stocks have pulled back from recent highs over the past month, but the bull market is likely not over. History shows that the stock market stays in an upward trend for longer stretches than it falls; that’s why it has averaged an annualized return of 10% over the past century.

Amid the various sectors, real estate investment trusts (REITs) offer great value and could outperform the market averages over the next few years. These companies are required to distribute at least 90% of their profits to shareholders in dividends. And among REITs, Realty Income (NYSE: O) maintains a quality property portfolio that has led to an impressive dividend growth streak.

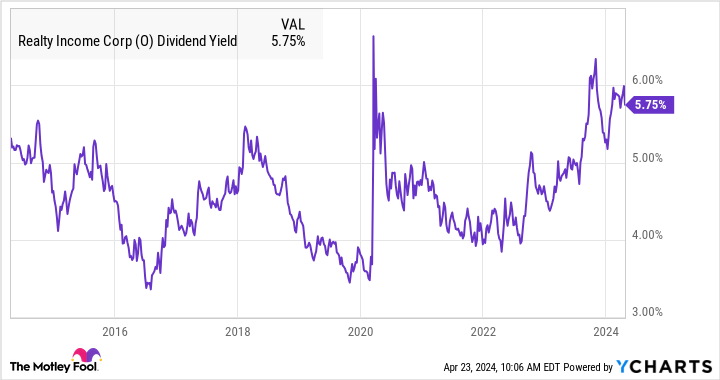

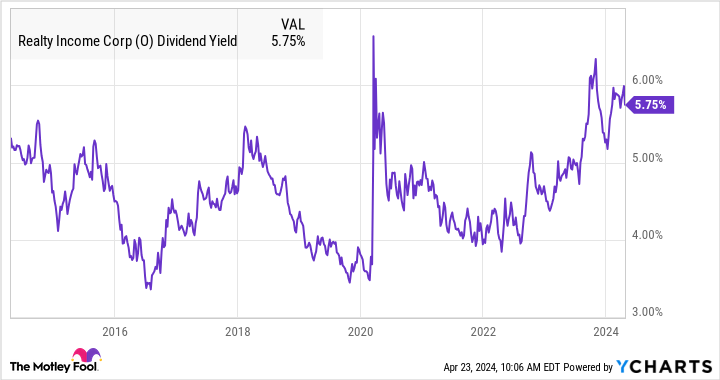

Now, after a recent pullback, the stock offers its highest yield in a decade. Here are three reasons why Realty Income stock is a fantastic buy right now.

1. A sound investment strategy

Realty Income follows a smart investment strategy within the commercial real estate market. Over 80% of its clients are within the retail sector, but it focuses on investing in properties owned by companies that are leading in their respective markets. Among its largest clients are familiar names including Dollar General, Walgreens, FedEx, and Walmart.

Warren Buffett always advocates investing in companies with sustainable competitive advantages, and that’s exactly what Realty Income looks for in its retail clients. Its property portfolio focuses on businesses that sell goods at low prices. It also likes to invest in clients that can continue to grow in an age when more retail spending is shifting online.

The proof is in the pudding. Realty Income has increased its monthly dividend for 25 years, and recently declared a monthly distribution of $0.257 per share for April.

2. A $14 trillion addressable market

Historically, REIT stocks have underperformed the S&P 500 index as a group. Investors generally buy REITs for their dividend yields more than anything else, but the underperformance gap between REITs and the rest of the stock market has widened — and that’s a good thing for value investors.

Realty Income shares are down 14% over the past year. However, its focus on high-quality properties and attractive yield of 5.75% indicate the stock is undervalued, and is due for a rebound sooner or later.

The company is actively looking to invest more capital in properties at attractive values. It’s starting to find opportunities in the data center market, where it completed a $200 million initial investment in a joint venture with Digital Realty in the fourth quarter.

Overall, management estimates there are $14 trillion worth of properties in the U.S. and Europe that could become new investments. This means the company should have no problem adding to its portfolio to grow the dividend for many years.

3. An attractive dividend yield for a strong business

Retail spending can come and go with the health of the economy, but there have been very few years over the last several decades when retail spending has declined year over year. Annual growth in retail sales averaged 4.8% since 1993.

Either way, the growth of retail sales doesn’t matter. Realty shareholders are not betting on the success of a single retail company, and they are not even betting on the company’s clients to grow their sales. As long as the company’s clients can simply pay their rents, shareholders will do well.

Realty Income’s dividend yield is the highest it has been in a decade. If history is any indication, this window of opportunity may not last long.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $506,291!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

A Bull Market Is Here. 3 Reasons to Buy Realty Income Stock Like There’s No Tomorrow. was originally published by The Motley Fool