New Finance app insights report shows renewed interest in crypto; details how tech advancements, increased user spending and engagement will drive industry growth

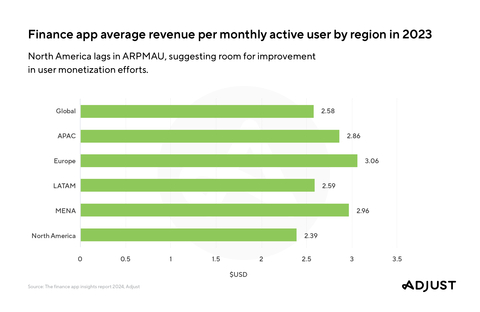

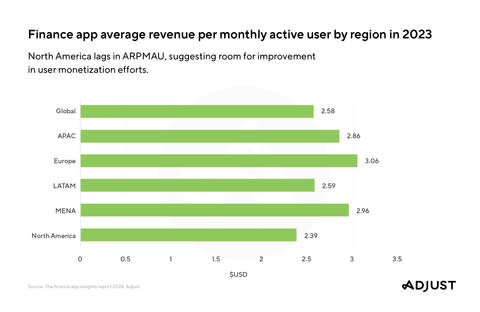

SAN FRANCISCO, June 27, 2024–(BUSINESS WIRE)–Today, leading measurement and analytics company Adjust released its Finance app insights report showing a global finance app industry poised for growth in H2 2024 – driven by technological advancements, increased user spending and engagement, and strategic market expansions. In-app revenue for finance apps in the first quarter of 2024 increased 119% YoY, underscoring their robust growth trajectory, especially in regions like Europe and LATAM, where effective user engagement and monetization strategies are visibly paying off. The report also indicates a renewed interest in cryptocurrency trading and management as global crypto app installs soared 196% YoY from 2022 to 2023.

“Despite the tumultuous economic conditions of recent years, the outlook for the remainder of 2024 and beyond is promising,” said Tiahn Wetzler, Director, Content & Insights at Adjust. “By leveraging next-generation measurement approaches, such as incrementality and media mix modeling, alongside traditional attribution, finance app marketers can unlock new avenues for growth. Emphasizing secure, user-friendly experiences with a focus on personalization will be crucial in retaining users – maximizing lifetime value and driving sustained success.”

The finance app insights report provides finance app marketers and developers with key insights, including:

-

Significant global finance app growth in 2024. Q1 installs were up 36% YoY and sessions were up by 23%.

-

Rise in mobile payments and banking illustrates shift towards digital-first financial solutions. Bank app installs surged 111% YoY in Q1 2024; payment app sessions increased 27% YoY in 2023, with session lengths up by 12% YoY in Q1, highlighting their essential role in daily transactions.

-

The APAC region is primed for growth. While the median effective cost per install (eCPI) for finance apps was $1.21 globally, APAC had the lowest eCPI at $0.63, indicating a favorable growth environment.

-

App Tracking Transparency (ATT) opt-in rates for finance apps have continued to climb globally from 18% in Q1 2023 to 25% in Q1 2024.

For additional findings and analysis, download the full report here.

About Adjust

Adjust, an AppLovin (NASDAQ: APP) company, is trusted by marketers around the world to measure and grow their apps across platforms, from mobile to CTV and beyond. Adjust works with companies at every stage of the app marketing journey, from fast-growing digital brands to brick-and-mortar companies launching their first apps. Adjust’s powerful measurement and analytics provide visibility, insights and essential tools that drive better results.

SOURCE: Adjust

View source version on businesswire.com: https://www.businesswire.com/news/home/20240627094885/en/

Contacts

Adjust

Joshua Grandy

[email protected]