What’s the main downside to a new bull market? Valuations can become frothy. The average S&P 500 stock trades at nearly 21.5 times estimated earnings. Many stocks have much steeper valuations.

But don’t think for a second that there aren’t bargains to be found. Here are five magnificent stocks to buy that are dirt cheap (listed in alphabetical order).

1. Ares Capital

You might not be familiar with Ares Capital (NASDAQ: ARCC). However, it’s the largest publicly traded business development company (BDC) in the U.S. Its stock is also one that value investors could find quite attractive. Ares Capital’s forward earnings multiple is a low 8.8x.

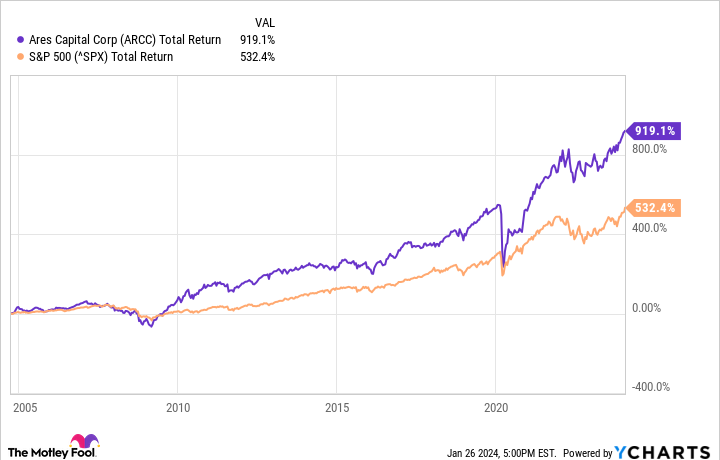

That discount valuation isn’t the only thing to like about Ares Capital, though. The BDC’s dividend yield tops 9.4%. This dividend gives a big boost to the company’s total return. Since Ares Capital’s IPO in 2004, its total return has trounced the S&P 500.

2. Energy Transfer LP

Energy Transfer LP‘s (NYSE: ET) units have more than doubled in value over the last three years. Despite the big gains, the midstream energy provider remains a bargain with its forward earnings multiple of only 8.3x.

The limited partnership also pays a hefty distribution that currently yields nearly 8.8%. Energy Transfer expects to grow its distribution by 3% to 5% per year. Its pipelines and processing plants generate steady cash flow that should allow the company to easily fund those distributions going forward.

3. ExxonMobil

ExxonMobil (NYSE: XOM) stands out as another energy stock that’s available at a discount. Shares of the oil and gas giant trade at roughly 10.7 times expected earnings. That’s well below the S&P 500’s level and is also lower than the average energy sector forward earnings multiple of 11.2x.

The stock has been a longtime favorite of income investors. That’s still the case with ExxonMobil’s dividend yielding 3.8%. The company could even have better long-term growth prospects than many think with its major investments in carbon capture and storage.

4. PayPal Holdings

PayPal Holdings (NASDAQ: PYPL) turned out to be a disaster for investors in recent years. Since mid-2021, the fintech stock has plunged by nearly 80%. However, this steep sell-off has made PayPal absurdly cheap. Its forward earnings multiple is below 11.4x. PayPal’s price-to-earnings-to-growth (PEG) ratio, which factors in projected growth over the next five years, is a super-low 0.54. Any PEG ratio below 1.0 is considered to be an attractive valuation.

Although PayPal’s growth has slowed considerably, the company’s underlying business remains quite healthy. In the third quarter of 2023, PayPal’s total payment volume jumped 15% year over year. Its adjusted earnings per share soared 20%. The digital payments pioneer also generated a free cash flow of $1.1 billion.

5. Pfizer

You might question my sanity with the inclusion of Pfizer (NYSE: PFE) as a “magnificent” stock to buy right now. Shares of the big drugmaker sank nearly 40% over the last 12 months. The stock is down 55% from its peak set in late 2021.

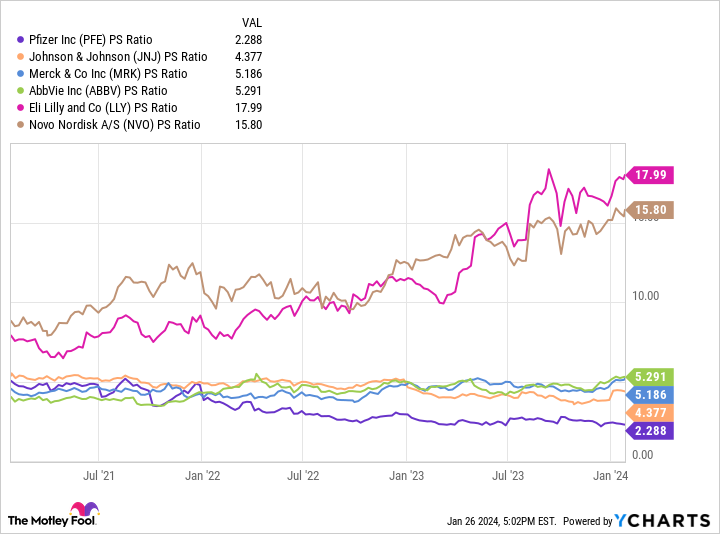

Pfizer looks like a bargain, in my view, though. Its shares trade at 12.6 times expected earnings — much lower than the S&P 500 healthcare sector average of 18.4. Pfizer’s price-to-sales ratio is only a fraction of the multiples for its big pharma peers.

Sure, Pfizer deserves a lower valuation because of its declining COVID-19 product sales and upcoming patent expirations for top-selling drugs. However, I think the outlook for the pharmaceutical company is much better than it seems to be at first glance. As a bonus, Pfizer pays a juicy dividend with a yield of 6.1%.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

Keith Speights has positions in Ares Capital, PayPal, and Pfizer. The Motley Fool has positions in and recommends PayPal and Pfizer. The Motley Fool recommends the following options: short March 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.

5 Magnificent Stocks to Buy That Are Dirt Cheap was originally published by The Motley Fool